The entire world saw havoc in every aspect of life due to the COVID-19 pandemic. Most businesses experienced short closures, lost a lot of business and had to deal with adjusting their workforce. In an effort to ease these impacts, the U.S. government rolled out a number of relief programs and one of them is the Employee Retention Credit (ERC).

The ERC was designed to encourage businesses to keep employees on payroll during uncertain times. Unlike a loan, it’s a refundable tax credit, which means eligible employers can receive a direct refund even if they owe no taxes.

The ERC has come a long way since it was originally created in 2020 as part of the CARES Act. While rule changes, new legislation, and IRS clarifications have made it clear, there are certain things that make understanding the Employee Retention Credit still a challenge.

This blog will help you understand about ERC claims, who is eligible, how much you can claim, how to apply, and more. Regardless of whether you are a small business owner, nonprofit, or startup, this guide will inform you how the ERC works and how it may be able to help your business.

What Is the Employee Retention Credit (ERC)?

ERC, or Employee Retention Credit, is a refundable tax credit that’s aimed at businesses that kept on paying their employees through COVID-19. The ERC was created as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act back in March 2020 to provide a tool for employers to help keep employees on payroll during difficult periods.

This is how it works: ERC provides partial reimbursement for qualified wages for each employee paid during certain quarters in the pandemic. Rather than being a deduction that simply reduces taxable income, this credit reduces the tax owed and, in many cases, gives a cash refund.

Originally, the ERC was not as generous and was not available to businesses that received Paycheck Protection Program (PPP) loans. That said, many of these legislative updates (such as the Consolidated Appropriations Act (CAA) and the American Rescue Plan Act (ARPA) made the credit more beneficial and opened up the possibility of various bases of companies being able to obtain both PPP and ERC benefits (with some restrictions).

While the credit has now expired for the majority of businesses, any eligible employer is still able to retroactively claim it by filing amended payroll tax returns.

In other words, the ERC is a huge opportunity to recoup dollars spent on wages that have already been paid—which makes it one of the most potent relief weapons from the pandemic era.

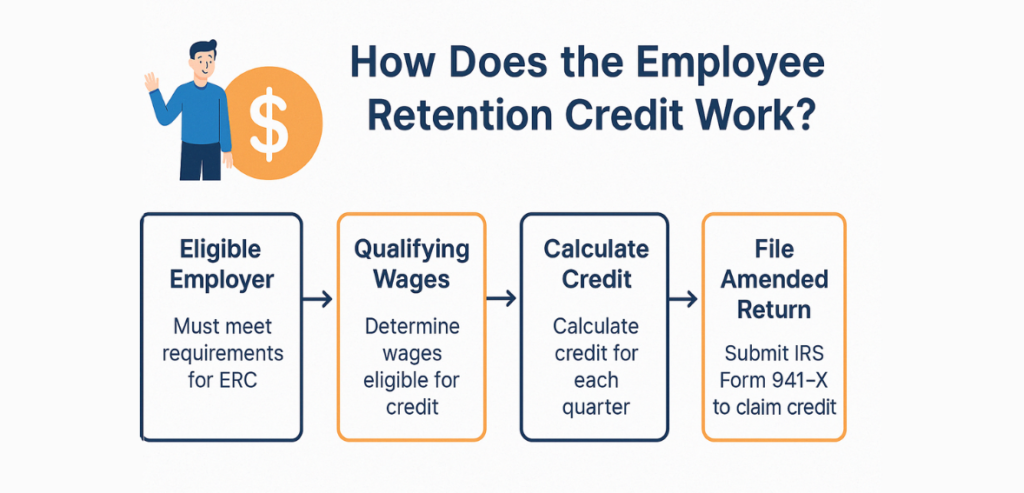

How Does the Employee Retention Credit Work?

If you are in a dilemma and wondering how the Employee Retention Credit works, then you are not alone. Here’s the gist. With ERTC, the amount of refundable tax credit that you may be entitled to is the sum of certain specified amounts paid to each employee that you paid wages to between the period of March 31, 2020, and September 30, 2021.

These refundable tax credits are deductions that lower the tax liability that a business is required to pay. As you may see, if your credit is more than your liability, you may even get a refund. Through less taxation, some amount of money is freed and can be used in expanding your profits or your business.

Who Is Eligible for Employee Retention Credit?

To qualify for the ERC, a company must meet one of the following criteria:

- Shutdowns Mandated by Government: Businesses whose closure was mandated by government executive order as a result of COVID-19 are eligible. It is applied to the municipal or state law that limited a business operation or stopped a business from operating.

- Drop in revenue due to COVID-19: If your business experienced a significant drop in revenue due to the COVID-19 epidemic, you may be eligible. A business needed to show that it was down 50% in gross receipts over the comparable quarter from 2019 in order to qualify for an ERC for 2020. A fall of 20% was needed for 2021 to satisfy the requirement.

- Recovery Startup Businesses: Businesses that were started after February 15, 2020, and have average annual gross receipts of $1 million or less may qualify for the ERC.

If you are an eligible employer, you can get:

- 2020: 50% of qualified wages up to $10,000 per employee on an annual basis ($5,000 maximum per employee for the year)

- 2021: 70% of qualified wages paid up to $10,000 per employee per quarter ($7,000 maximum per employee per quarter)

What Are the Limitations of the ERC?

No doubt that the ERC offers a lot of financial benefits, yet there are some key restrictions every business owner needs to know before you apply for the credit.

1. No Double-Dipping with PPP Loans

You cannot claim the ERC on wages that were also used to qualify for Paycheck Protection Program (PPP) loan forgiveness. In other words, you must allocate wages carefully—the same payroll costs cannot be used for both the PPP and ERC.

2. Interaction with Other COVID-19 Relief Programs

Other forms of relief programs are also limited by this. If your business accepted funds via the Restaurant Revitalization Fund or the Shuttered Venue Operators Grant, you cannot claim the same wages for ERC.

How to Claim the Employee Retention Credit?

Employee Retention Credit does not come automatically. If you did not apply during the original filing period, you must file an amended payroll tax return on IRS Form 941-X (Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund).

This form enables you to claim the credit during the pandemic for the quarters for which you were eligible to do so. Once filed:

- The IRS will use the credit to offset any payroll tax owed

- Or send a cheque for paid taxes

It’s important to file accurately and promptly, as amended returns are subject to IRS processing times and audit reviews.

Avoiding Scams Related to Employee Retention Credit

With the rise of interest in the ERC has also come an increase in ERC-related scams. The IRS has issued numerous warnings about promoters attempting to mislead small businesses. This is how you can protect yourself:

1. Beware of Unsolicited Offers

If you get cold calls, emails, or texts that say you’re “guaranteed” a big ERC refund, be careful. Legitimate firms will consider your records first before making commitments.

2. Watch for High Fees or Commission-Based Pricing

Traditional professional tax advisors usually bill a flat or hourly rate. If someone asks for a large upfront fee or a percentage of your refund these are red flags.

3. Avoid “Guaranteed” Refund Claims

Without looking through your payroll and revenue records, there is no way to even begin to promise you that your business is eligible. Any “business qualifies” claim is probably a scam.

What to Do If You Filed an Ineligible ERC Claim?

If you have an existing claim but have subsequently realised your business isn’t eligible, you need to move quickly to avoid penalties and rectify the error:

1. Withdraw the Claim (If Not Yet Processed)

If your return has not yet been processed by the IRS, you may be able to request the withdrawal of the claim. This saves you from paying the penalties, interest, or even audit.

2. Return the Funds

When the claim is in the wrong and you get the refund, you can give back the cash prior to it being cashed or deposited.

Take advantage of the IRS Voluntary Disclosure Program

In the case that a business incorrectly received the ERC, the IRS has a Voluntary Disclosure Program. By participating, you may:

- Avoid serious penalties

- Repay only 85% of the ERC funds received

- Correct your filings without criminal exposure

These proactive measures not only help keep your business safe but can also assist you in compliance.

Claiming ERTC: Is It Still Applicable?

Although the Employee Retention Credit (ERC) was introduced as a temporary pandemic relief measure, eligible businesses can still claim it retroactively. The IRS continues to accept ERC claims, provided they meet the eligibility requirements for wages paid in 2020 or 2021.

Previously, the IRS imposed a moratorium on processing new claims filed after September 14, 2023, due to a rise in questionable submissions. However, this moratorium was lifted on August 8, 2023, allowing the agency to resume processing claims filed during the restricted period.

If you submitted a claim between September 14, 2023, and January 31, 2024, it is now under review. Although the U.S. House of Representatives passed a bill proposing January 31, 2024, as the cutoff for new claims, the Senate did not approve it. Therefore, the official deadline to amend 2021 payroll tax returns and claim the ERC remains April 15, 2025.

While you’re still allowed to submit new claims, be aware that the IRS is currently dealing with a significant backlog. Processing times may be extended, especially for claims requiring additional verification.

If you’re planning to file, now is the time to gather documentation, consult with a qualified tax professional, and submit your amended Form 941-X well before the 2025 deadline.

Conclusion

Undoubtedly, the ERC, or Employee Retention Credit, has proved to be one of the most effective tools for economic recovery any business has ever seen during and following the pandemic. This program was designed to incentivize business owners to maintain staff on payroll and is a great avenue to recoup money for wages that have already been disbursed, particularly for small and mid-sized business owners experiencing unpredictability.

Though the program has ended, businesses can still claim retroactively for ERC by filing amended payroll tax returns. Knowing your qualifications, rules for qualified wages, and common mistakes or scams is important to benefit from this credit.

If you are unsure if your business qualifies or you would like to have some assistance in computing your possible refund, speak to a certified tax professional. In a challenging economy, every dollar matters. The ERC remains a lifeline that could significantly boost your business’s cash flow—if claimed correctly and responsibly.

Frequently Asked Questions

Can I still apply for the Employee Retention Credit (ERC)?

Yes, if your business is eligible, you can still apply retroactively. You must file an amended payroll tax return (Form 941-X) for qualified quarters in 2020 or 2021.

Can I claim both PPP and ERC?

Yes, but you cannot claim ERC for wages paid with forgiven PPP loan funds. You must carefully allocate wages to avoid using the same payroll expenses for both programs.

How long does it take to receive the ERC refund?

Due to a backlog, processing times can vary, often taking several months. The IRS resumed processing paused claims as of August 8, 2023, so older submissions may take longer.

What documents do I need to claim ERC?

This exquisite compilation showcases a diverse array of photographs that capture the essence of different eras and cultures, reflecting the unique styles and perspectives of each artist.

What if I filed an ERC claim by mistake?

If you realize your claim was incorrect, you can withdraw it if not yet processed, or return the funds if already received. The IRS also offers a Voluntary Disclosure Program to correct improper claims with reduced penalties.

Leave a Reply